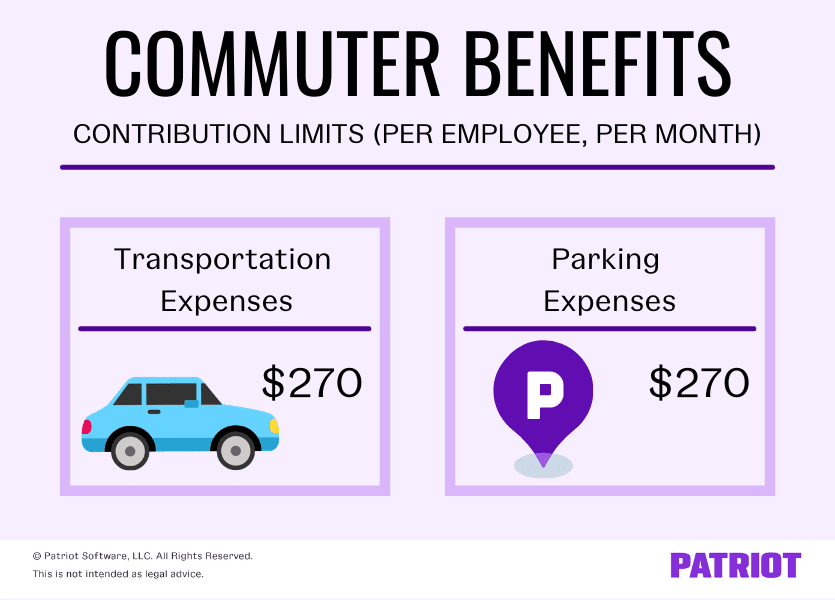

Irs Commuting Rule 2025 - IRS Mileage Commuting Rule What is The Purpose MileIQ, $325 per employee per month for. The adjustments, announced by the irs in late october, are designed to bring some relief to taxpayers through increases in standard deductions, tax bracket thresholds, and. Under section 132(f), employers can.

IRS Mileage Commuting Rule What is The Purpose MileIQ, $325 per employee per month for.

IRS officially announces paperless tax processing by 2025 — Kasminoff, The irs will announce its 2025 rates some time in december.

Irs Commuting Rule 2025. The adjustments, announced by the irs in late october, are designed to bring some relief to taxpayers through increases in standard deductions, tax bracket thresholds, and. Defining the irs mileage commuting rule.

Understanding the IRS Commuting Mileage Rules GOFAR, Mileage reimbursement rate for 2025:

Irs Maximum Contribution For Fsa 2025 Tedra Genovera, You can’t deduct the costs of taking a bus, trolley, subway, or taxi, or of driving a car between your home and your main or regular place of work.

Plan B Movie 2025. It's relatable, sweet, and filled with heart, making it an easy watch. Discover showtimes, read reviews, watch trailers, and find streaming options for plan b. Explore cast details and learn more on moviefone. Discover showtimes, read reviews, watch trailers, and find streaming options for plan b.

Commuter Maximums For 2025 Irs Angela Hudson, Get a sneak peek at the anticipated irs mileage rate for 2025, including predictions for business, medical, and charity rates.

Irs Roth Ira Limits 2025 Jasmine Parsons, Under section 132(f), employers can.

Commuter Maximums For 2025 Irs Angela Hudson, Learn how these changes could benefit your 2025 tax planning.

IRS 600 Dollar Rule How It Affects You •, The irs mileage reimbursement rate is a deduction you can take for using a vehicle.

Irs Transit Limit 2025 Starr Emmaline, The irs adjustments to the extra standard deduction for older adults come alongside increases in the standard deduction for all.